New Zealand Rural Land Co. invests in New Zealand Rural Land.

It partners with quality tenants and is listed on the NZX (Stock Code: NZ). New Zealand Rural Land is the best in the world,

as is New Zealand Rural Land Company.

NZL has a sustainable advantage: We have such a robust and sustainable investment case. EverGreen’s robust investment model:

Structural Trends: Global tailwinds set to endure

The world’s population is growing rapidly at a time when productive land is becoming scarcer. By 2050, the global population will reach 9.7 billion people, meanwhile the population is becoming more affluent and more particular on sustainable products. Overall, New Zealand’s temperate climate and low-input farming is the best-positioned globally to provide for global consumers hungry for premium [protein/produce].

Sustainable practices

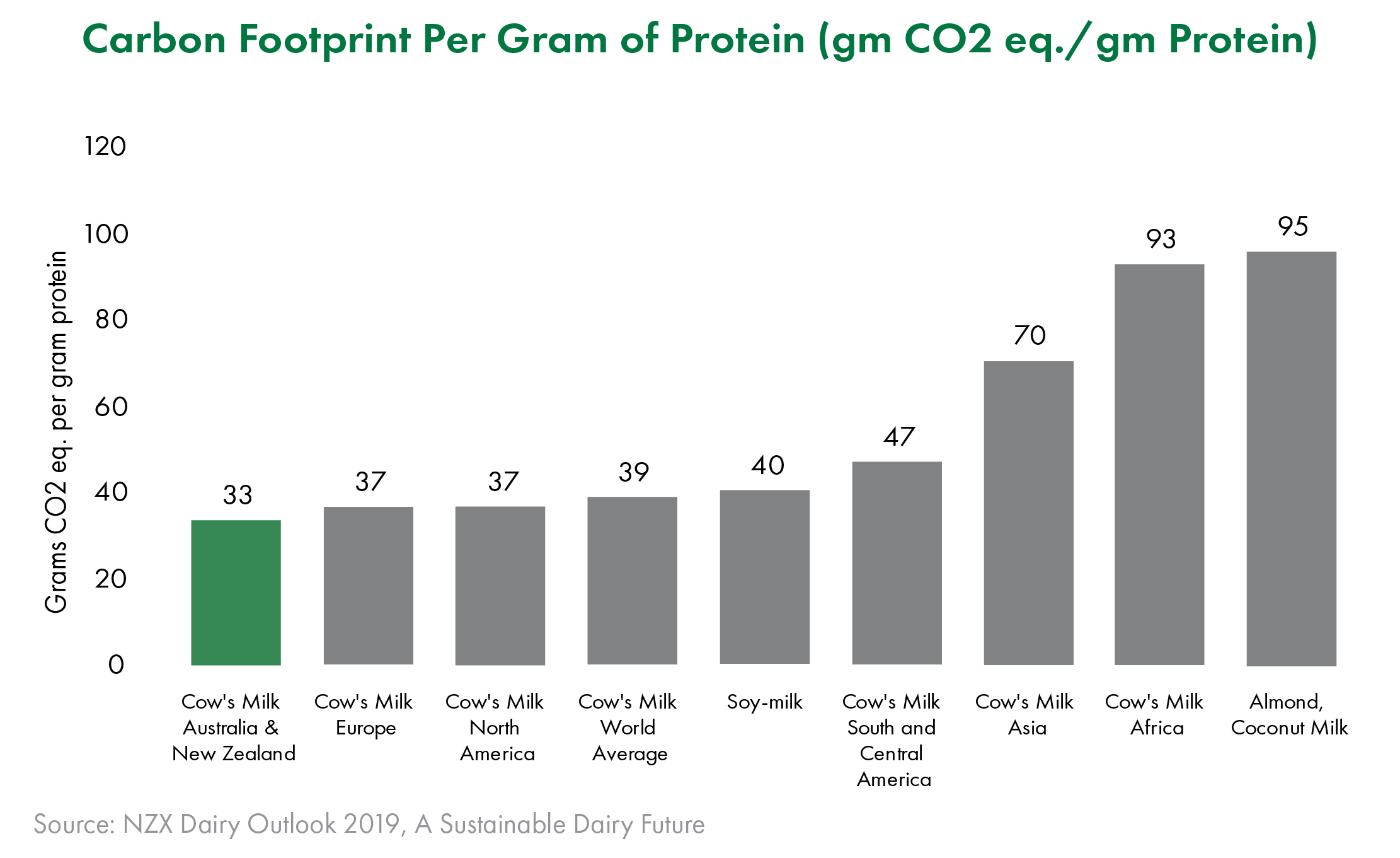

New Zealand has the world’s lowest carbon emissions for protein production. Also, plant-based milks have carbon footprints 188% higher than the NZ dairy industry.

NZL and its tenants operate individually and in partnership with sustainable practices, as contractually obligated in our industry-leading Sustainability Pledge. We only select tenants with the best track record of environmentally-sustainable performance.

Our sustainable structural advantage

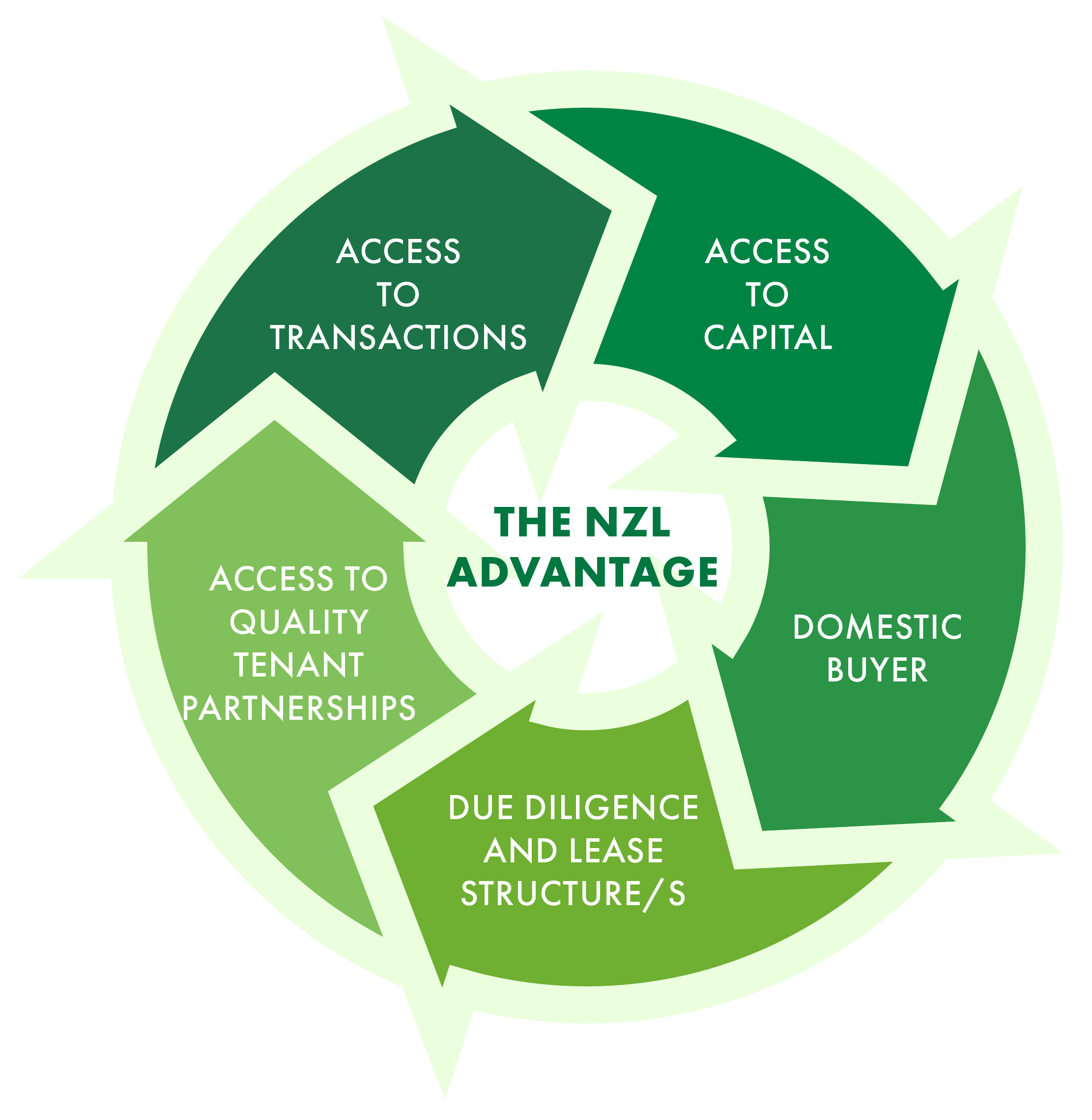

In a market with limited exposure to the primary sector, NZL offers a structural advantage:

domestic buyer

access to capital

access to transactions

proprietary process for due diligence and leasing

access to quality tenant partnership.

Attractive Risk

Compared to direct ownership of farming operations:

We only own the land.

Ownership of rural land only removes exposure to a myriad of risks faced by farmers, including on-farm operational risks, animal health risks, and direct exposure to volatility of commodity prices. Investors also have no direct exposure to farmer co-ops, limited exposure to environmental risks and greater liquidity (via the NZX) than syndicates or direct investment.

Compared to urban property REITS:

NZL gives investors lower risk of obsolescence and replacements as well as the surety of easy and costless alternative uses.

Strong returns

Against this comparatively low risk, NZL offers predictable, attractive returns. Over almost thirty years, New Zealand farm price returns have risen at an attractive 6.6% compound annual growth rate.

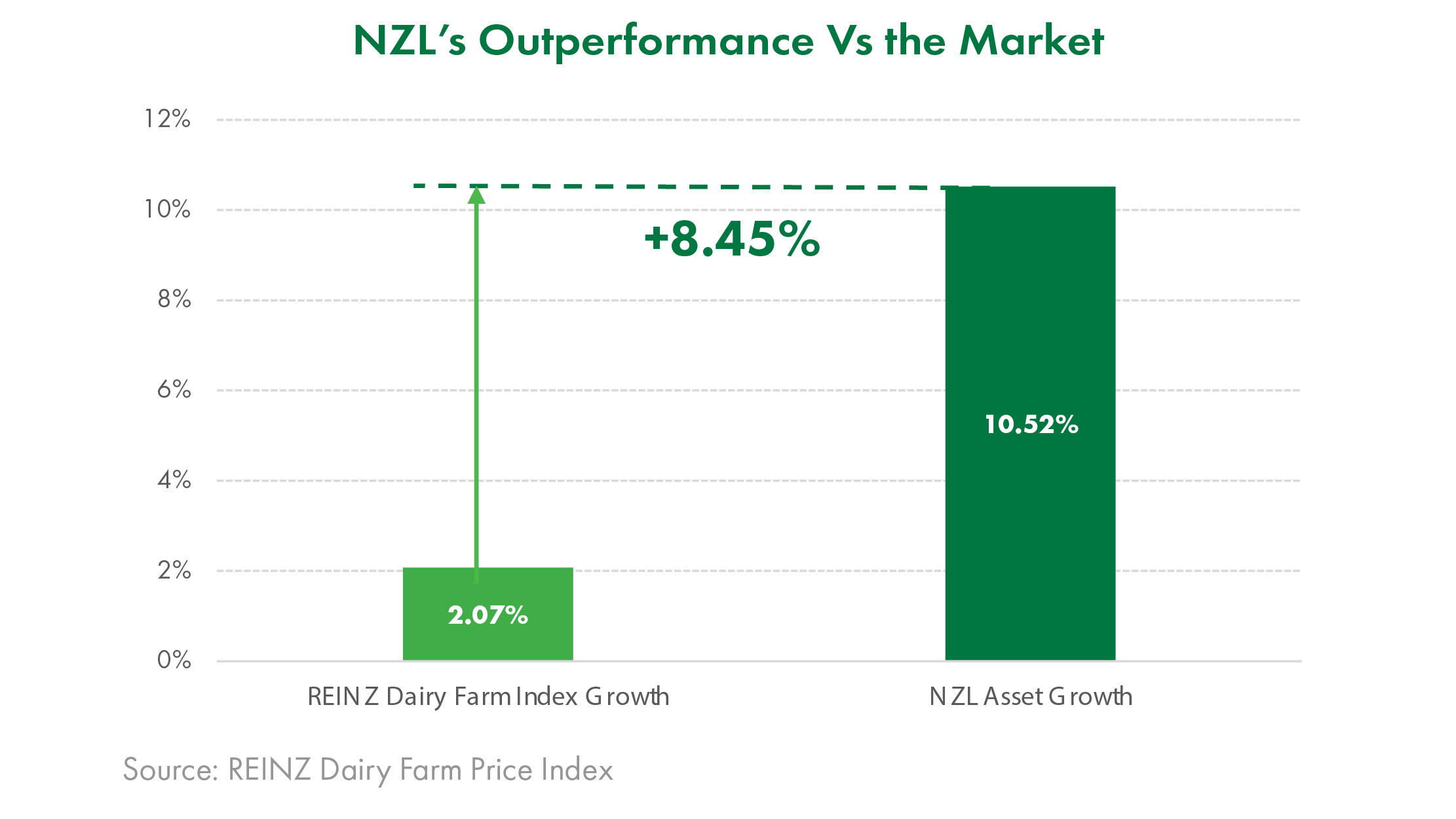

But NZL is committed to do even better. The team’s track record thus far has been solid and exceeded market returns, with 8.5% outperformance so far versus the comparable index (the REINZ Dairy Farm Index).

We believe the combination of our low risk and attractive returns leads to superior risk-adjusted returns compared to legacy rural investment vehicles, as well as most other NZX-listed companies.

NZL’s revaluation gains of +10.52%* were +8.45% higher than the +2.07% increase in the REINZ Dairy Farm Index in the months from December 2020 to 30 June 2021.